THORChain (RUNE) is a high-performance crypto project with a strong potential for future growth. This is because mainly of its cross-chain swap facility which lets users swap crypto across chains without losing custody in the process. Further, the blockchain has high-grade security. It also boasts of a well-developed and high-yield DeFi market with ample liquidity.

Factors Contributing to Fundamental Growth in THORChain

THORChain has several factors working in its favor that help it become a better blockchain than many other cross-chain DeFi protocols. At the core is its cross-chain protocol that lets you transfer crypto from one chain to another without wrapping, locking, conversion or other non-custodial processes. This multichain swap feature is supported by a highly profitable DeFi solution that enjoys the highest grade of security.

1. Native Cross-Chain Swaps

Thorchain enables native cross-chain swaps between different blockchain networks without wrapping assets (like wrapping Bitcoin on Ethereum).

The blockchain is compatible with a wide range of blockchains, including Bitcoin, Ethereum, Binance Chain, Litecoin, Dogecoin, and more. Its broad compatibility makes it more versatile than many DeFi protocols that are limited to specific ecosystems.

Users can swap assets in their native form directly between chains in a decentralized manner without losing custody in the process. This is much safer than transferring your crypto to an exchange, swapping it and then sending it back to your wallet.

The platform uses its native token, RUNE, as a cross-chain settlement asset. Every pool in the Thorchain ecosystem is paired with RUNE, allowing it to function as a bridge for liquidity across multiple chains, enhancing liquidity and reducing swap fees.

Further, unlike many DeFi protocols that rely on wrapped assets, Thorchain allows users to trade the actual asset, reducing reliance on third parties and avoiding risks associated with wrapped tokens (e.g., centralization risk).

2. High Yield Liquidity Pools

The yield rates at THORChain are higher than most of its competitors. It gives an APY of 10% to 18%, which is higher than Ethereum’s 2.34%, BNB’s 5%, Cardano’s 2.79%, etc.

It also offers impermanent loss protection for liquidity providers, which gradually increases over time. After 100 days of liquidity provision, the platform fully compensates for any impermanent loss, making it more attractive for long-term liquidity providers.

3. Decentralized and Non-Custodial

Thorchain is fully decentralized and non-custodial, meaning users retain full control of their assets throughout the swapping process. Unlike centralized exchanges, Thorchain doesn’t require users to trust a central authority with their funds.

When a swap occurs, the funds are swaped, they are directly credited from your wallet to the pool and deposited from the pool to your wallet.

5. High-Security Blockchain

Thorchain’s security model uses a rotating set of nodes to validate transactions and secure the network. These nodes are incentivized with rewards and slashed if they act maliciously, contributing to a robust, decentralized security mechanism.

6. Resilient Against Front-Running and MEV:

Thorchain’s architecture is designed to be resilient against front-running and Miner Extractable Value (MEV) exploits. By using techniques like continuous liquidity pools, it makes it difficult for bots and miners to manipulate transaction order for profit.

7. Community-Driven and Permissionless:

Thorchain is permissionless and open-source, meaning anyone can participate in the network or propose improvements. This community-driven approach fosters innovation and ensures the platform evolves according to the needs of its users.

About THORChain (RUNE)

Thorchain is a cross-chain decentralized finance (DeFi) protocol that lets you swap any two crypto pairs without losing the custody of any crypto for a single moment.

The technology is highly sought after because intra-blockchain asset transfers are still a major hurdle for crypto users as well as blockchains. Though there are many cross-chain protocols like Chainlinks CCIP, yet these protocols are limited to just a couple of assets or a handful of chains.

RUNE is the native token of the ecosystem. Its value is determined by the amount of assets deposited on the THORChain.

You can also deposit crypto in the pools to earn a high yield rate. Conversely, if you need funds, you can borrow from the protocol.

Supported Wallets and Cryptocurrencies

THORChain currently supports 29 assets like ETH, BNB, BTC, USDC, USDT, BCH, BSC, WBTC, AVAX, DOGE, LTC, and many others.

The protocol supports the following wallets:

- Rango Wallet

- THORWallet

- Lends

- Ferz Wallet

- DecentralFi

- DeFi Spot

- Unizen

- ShapeShift

- Edge Wallet

- XDEFI Wallet

- AsgardX

- Trust Wallet

- Thorswap

Network Statistics

- Total Value Locked: $863.5 million

- On-Chain Liquidity: 276.5 million.

- Total Validator Bond: $587 million

- Lifetime Volume: $69.8 billion.

- Total Pool Earnings: $119.3 million.

- Total Swap Count: 35.65 million

- Unique Swappers: 112,800 approx

- Active Validators: 111

Disclaimer: These figures are subject to change and are updated frequently on our website. To view the instantaneous figures, please visit THORChain.

THORChain has better vital stats than some of its large competitors.

- For example, at press time, the TVL of Cardano was at $192 million which is lower than THORChain.

- Further, it offers a better APY of 10% to 18%, which is higher than Ethereum’s 2.34%, BNB’s 5%, Cardano’s 2.79%, etc.

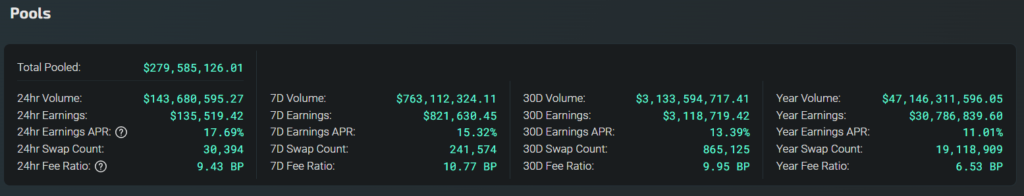

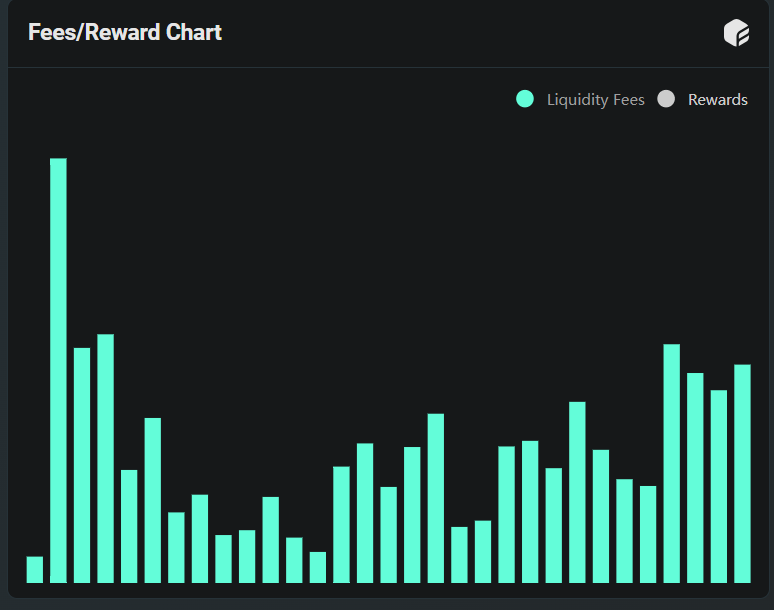

Earnings Analysis

THORChain has a very high earning figure. The blockchain protocol earns $20k to $300k every day on a sustained basis which takes its annual revenue up to $12 billion approximately.

Below is a graph of its revenue from 24 August to 24 September 2024.

Tokenomics

THORChain had the following token distribution at its ICO in 2019.

- Liquidity Emission – 50%

- Operational Reserve – 13%

- Marketing – 12%

- Founders and Advisors – 10%

- Others – 15%

At present, it has the following statistics:

- Total Supply: 414,060,293 RUNE

- Circulating Supply: 336,205,641 RUNE

The project burnt around 60 million tokens in Feb 2024.