Just after serving his 4 months prison sentence, Binance Chairman Changpeng Zhao has seen his wealth surge to over $70 billion. This surge in wealth was a result of Binance’s domination among all the crypto exchanges.

Rising Crypto Volumes Means More Business

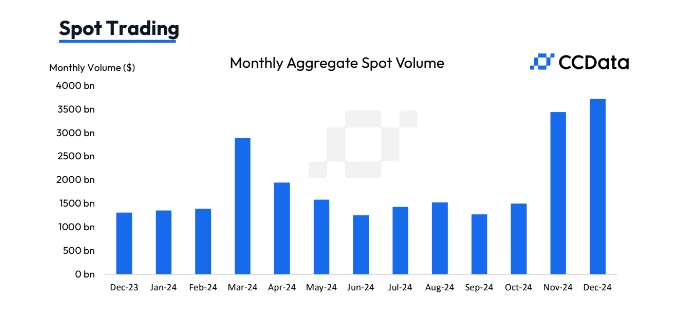

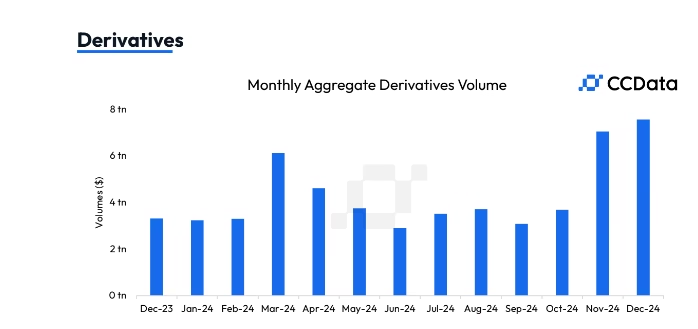

2024 saw a major rise in crypto trading, especially spot trading and derivatives trading. This surge was the highest in the last two months when Donald Trump won the election results. Expectations of pro-crypto presidential executive orders led to a market surge even before Donald Trump assumed office.

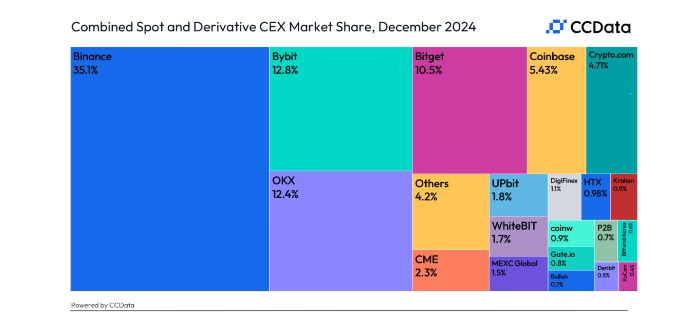

According to a report by CC Data, Binance now has a 35% market share of CEXs and DEXs in both spot trading and derivatives, as per data for the month of December 2025.

This rise in the market dominance of Binance was a result of compliance with US and Indian regulators, two of its largest markets. In the US, Binance pleaded guilty and CZ was ordered to step down from the position of its CEO. He was incarcerated for four months and incurred a $50 million fine.

However, in India, Binance’s journey was a bit smoother. Compliance with the FIU, the proto-crypto regulator in India helped Binance regain its position which it lost after a shadow ban earlier last year.

CZ Converting Binance Labs into a Family Office

With the rise in his net worth, Changpeng Zhao has decided to choose a more strategic role in Binance. His decision to convert Binance Labs into a family office is expected to help raise his control over it.

Binance Labs has played a crucial role in backing multiple companies that eventually turned out to be the top in their field, starting from Trust Wallet, CoinMarketCap, and the crypto launchpad Blum.

Some other top crypto platforms where Binance Labs holds a significant share are Uniswap, Pancakeswap, and Binance.US.

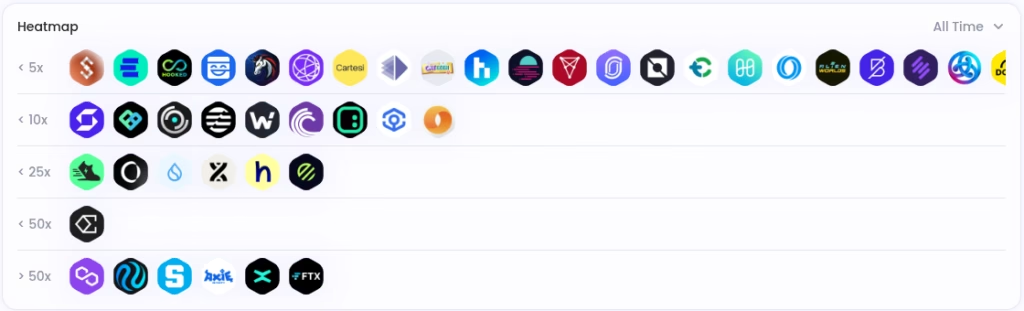

At present, Binance Labs is an investor in over 125 crypto projects. Below is a snapshot of top gainers and losers in Binance Lab’s portfolio.