Highlights

- In October 2024, Tether celebrates its 10th anniversary after first being conceived as Realcoin in 2014.

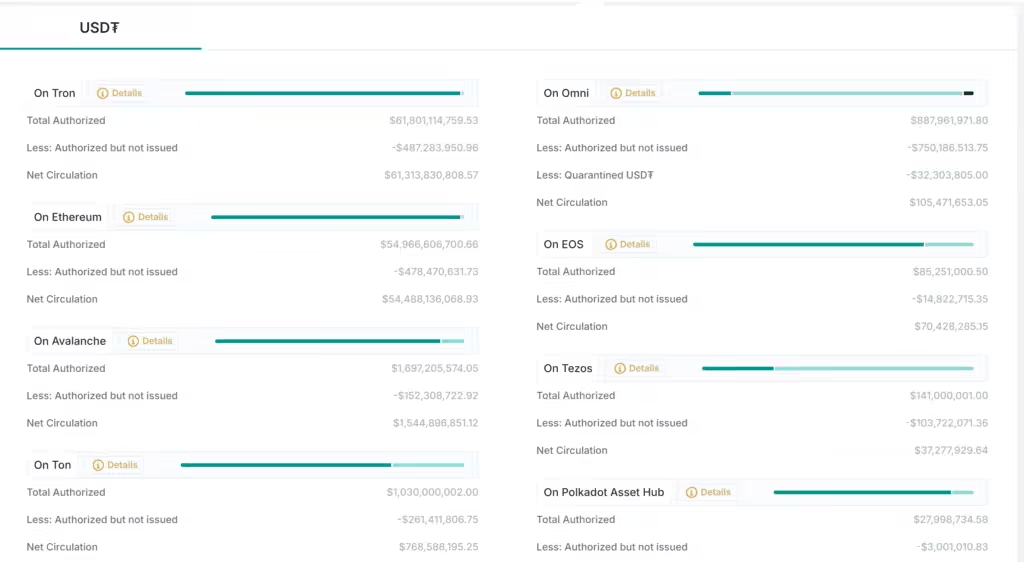

- It was first launched on the Bitcoin blockchain but now primarily exists on Ethereum and Tron.

- USDT plays a key role in the general crypto and DeFi ecosystem as well as in cross-border payments.

- The stablecoin has a market cap of $119 billion and outranks its largest competitor by a market cap thrice larger (than USDC).

Most of us would be shocked to know that Tether, the largest stablecoin issuer in the current crypto world, had started its journey even before Ethereum was conceptualized.

Tether was conceptualized based on another cryptocurrency called Mastercoin where both founders of Tether worked as top executives. It was initially conceived as “Realcoin” in 2014 but was later renamed to Tether within the first year of its conception.

Also, the stablecoin was initially launched on the Bitcoin blockchain and not on Ethereum or Tron, where it exists today.

Started as the Crypto Project “Realcoin”

Tether started as the crypto project Realcoin to solve the problem of value transfer within the nascent crypto world.

It was conceptualized after J.R. Willet published a whitepaper talking about a cryptocurrency on top of the Bitcoin blockchain. From this whitepaper, the Mastercoin was born where Tether founders Brock Pierce and Craig Sellars became the founding members.

Mastercoin served as the technological foundation of Realcoin. Pierce and Sellars soon incorporated a startup in Santa Monica, US, named Tether Inc. By July 2014, the new project Realcoin was announced.

Soon on 6 October 2014, the first tokens of Realcoin were issued on the Bitcoin blockchain. The initial plan was to launch three tokens namely US Tether (US+), Euro Tether (EU+) and Yen Tether (Yen+).

Realcoin was later renamed to Tether on 20 November 2014 to better reflect its uniqueness and presumably to shed down its former name which sounded a bit generic.

Navigating Some of the Worst Times

Tether had to endure several challenges to make it to the point where it is now, the largest stablecoin issuer that surpasses all of its competitors combined together.

The US regulator Commodities Futures Trading Commission, CFTC, fined Tether for keeping a full reserve for only 27.6% of the days between 2016 and 2018 and also for failing to submit audits of its reserves from an independent auditor.

When TerraUSD (UST) de-pegged from the US Dollar, it faced a massive sell-off triggering a panic attack in the entire stablecoin markets.

Traders began to short UST because the crypto was already in a free fall. Other cryptocurrencies that faced a de-peg like USDT also faced a shorting from crypto traders worldwide. The markets did not expect such a de-peg in a collateral-backed stablecoin and as a result, mass withdrawals took place in USDT too.

Soon USDT also faced de-peg and slid to 0.91 by 12 May. The stablecoin recovered quickly above $1 but the de-peg triggered another panic moment for all USDT users.

Thankfully, USDT had a sufficiently large market cap that prevented its capitulation and within a couple of days, the stablecoin recovered from its de-peg.

Playing a Central Role in Crypto and DeFi

USDT plays a key role in providing liquidity to the entire DeFi ecosystem, for L1 blockchains as well as thousands of Dapps.

It also serves a major role in cross-border payment settlement within the crypto community worldwide.

Tether plays a central role in decentralized finance accounting for almost all of the liquidity in DeFi protocols. As per estimates, more than half of BTC trades take place via USDT.

Further, Tether accounts for almost all the liquidity on the Ethereum and Tron blockchains, exceeding volumes of $50 billion each. On Ethereum, out of the $84 billion stablecoins, Tether accounts for $54 billion. On Tron, Tether has an even more overwhelming presence as the stablecoin issuer accounts for almost all of the on-chain stablecoins.

Tether Crosses $100 Billion

The stablecoin has the largest market cap among all its peers at $119 billion. It crossed the $100 billion mark on 6 March 2024 during the pre-halving market rally.

USDT now accounts for a much larger market cap than all its competitors, probably twice that of all other stablecoins combined.

USDT vs USDC

USDC which once gave neck-to-neck competition to Tether has now fallen to $35 billion, less than 1/3 of Tether’s. Though the regulatory environment in the US shares a major part of the blame, the Silicon Valley Bank collapse hastened the process.

On 10 March 2023, the SVB collapsed, temporarily locking $3 billion worth of USDC’s collateral. This triggered a panic among the users who redeemed most of their stablecoin holdings. Though afterward, all the money was successfully recovered, USDC lost the trust it once enjoyed, reducing it to the state that it finds itself in today.