Around $90 billion of crypto is being stored in various exchanges, DeFi protocols, liquidity pools, and other instruments. This number is significantly higher than the past couple of years since the 2021 market highs. The drivers behind high growth in crypto users are the regulatory breakthrough, surge in retail demand, the success of Bitcoin ETFs, and institutional investments (e.g., Microstrategy).

However, such huge wealth also attracts criminals who always find a quick way of making money via the wrong means. In this quarter too, cybercriminals have managed to loot $412,994,499 worth of crypto. Out of this $409, 906,947 was hacked from various exchanges while $3,087,552 was stolen via fraud.

Out of this, $14.9 million was successfully recovered from the hackers.

The crypto loss figures see a 40% decline compared to the previous year when in Q3 of 2023, the net crypto loss was $685,970,444.

WazirX and BingX Account For $287 Million in Losses

Centralized Exchanges were at the front of crypto losses accounting for 74.8% of total losses while DeFi accounted for the other 25.2% in loss.

Among Centralized Exchanges, WazirX lost $235 million while the Singaporean exchange BingX lost $52 million. Both exchanges are registered in Singapore but WazirX caters to the Indian crypto market.

Despite several attempts, the hackers of WazirX, still remain at large and are reported to have laundered all the proceeds from the hack.

Frauds Only Cost $3 Million in Crypto Loss

This year, crypto losses due to fraud saw an 86.4% decrease at $3,087,552 as compared to last year’s $663,310,580.

This drastic reduction has been possible after limitless efforts from the entire ecosystem. From a time (2015 to 2018) when crypto fraud used to be the norm, the current situation took a lot of effort, positive regulations, and patience from the users.

Losses by Blockchain

Out of the 33 hack incidents reported by ImmuneFi, the following are the share for each chain:

- Ethereum – 15

- BNB – 8

- Base – 2

- Blast – 1

- Arbitrum – 1

- Solana – 1

Please understand that this list does not imply that the blockchains were hit. It just says that out of all the hacks, crypto was swept out from these blockchain addresses.

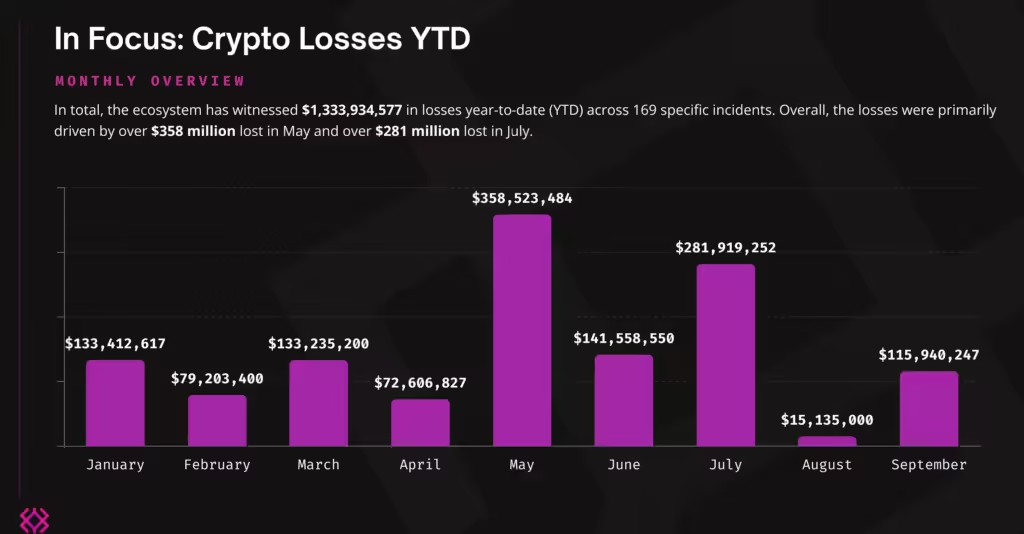

Crypto Losses By Month

The losses by each month were as follows:

- January – $113,412,614

- February – $79,203,400

- March – $113,235,200

- April – $72,606,827

- May – $358,523,484

- June – $141,558,550

- July – $281,919,252

- August – $115,940,247

We have eliminated September losses ($115,940,247) from the list as the month had not ended at the time of reporting.