AAVE is a DeFi platform with high growth potential, operates in a market with a very high CAGR, has a high demand, and is a leader in a highly viable financial sector considering future needs.

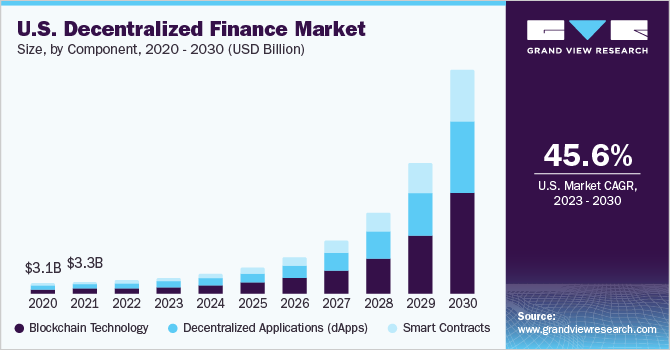

We estimate AAVE to have a compounded annual growth rate of 45%, in line with the estimated growth of the overall DeFi markets.

Purpose & Use Case

The purpose of building AAVE was to provide a simple but robust DeFi platform that can do basic tasks as well as advanced ones. The platform allows users to do basic DeFi operations like lend, borrow, and stake in a safe but easy-to-use environment for a rich user experience.

Value Proposition

AAVE’s core value lies in its simplicity and its scale of operations.

As mentioned earlier, the project is highly simplistic in its current, third iteration (AAVE v3).

Further, the sheer scale of liquidity and usage volume on the platforms ensures that a user can enter as well as exit the markets in a fraction of a moment without suffering much slippage in asset values. This ensures a highly efficient DeFi trading experience where the losses due to slippage are reduced to mere cents.

The platform has a net liquidity of $20.2 billion, out of which $14 billion is locked with various liquidity and staking mechanisms. This makes AAVE the second-largest DeFi protocol after Lido and the largest crypto-lending platform on Ethereum.

Whitepaper

AAVE’s whitepaper is

Team and Leadership

AAVE is operated and maintained by AVARA, a financial company headquartered in the U.K., however, its governance and decisions are decentralized and are done by holders of AAVE Token via the AAVE DAO.

The top executives at AVARA are:

- Stanley Kulechov, Founder and CEO

- Peter Kerr, Chief Financial Officer (formerly Deutsche Bank and HSBC)

- Claudia Cenceros, Chief Communication Officer (formerly Cisco)

- Nicole Butler, Chief Compliance Officer (formerly Coinbase)

Technology and Infrastructure

- Blockchain

- Consensus Mechanism

- Scalability

AAVE is a DeFi protocol built on Ethereum. All the cryptocurrencies on the platform are ERC-20 tokens. AAVE leverages Ethereum’s trust, security, on-chain liquidity, and ecosystem support to support its operations.

Since Ethereum implemented its Dencun Upgrade and is about to implement the Sharding upgrade, it will make AAVE highly scalable helping it achieve instant transaction settlement and finality. Even at the current phase, AAVE can settle transactions within a few minutes and has benefitted from Ethereum’s Dencun Upgrade which helped reduce transaction costs by 99%.

Tokenomics

The AAVE token which is at the core of its infrastructure is an ERC-20 governance token that can also be staked to earn rewards.

AAVE also has its stablecoin named GHO, which is an acronym for Ghost. The Finnish word for Ghost is Aave.

AAVE had its ICO in 2017 when it was known as ETHLend. Soon, holders were asked to swap LEND with AAVE tokens after the project was renamed. Holders got 1 AAVE for 100 LEND.

The token distribution at that time is shown below in percentage terms.

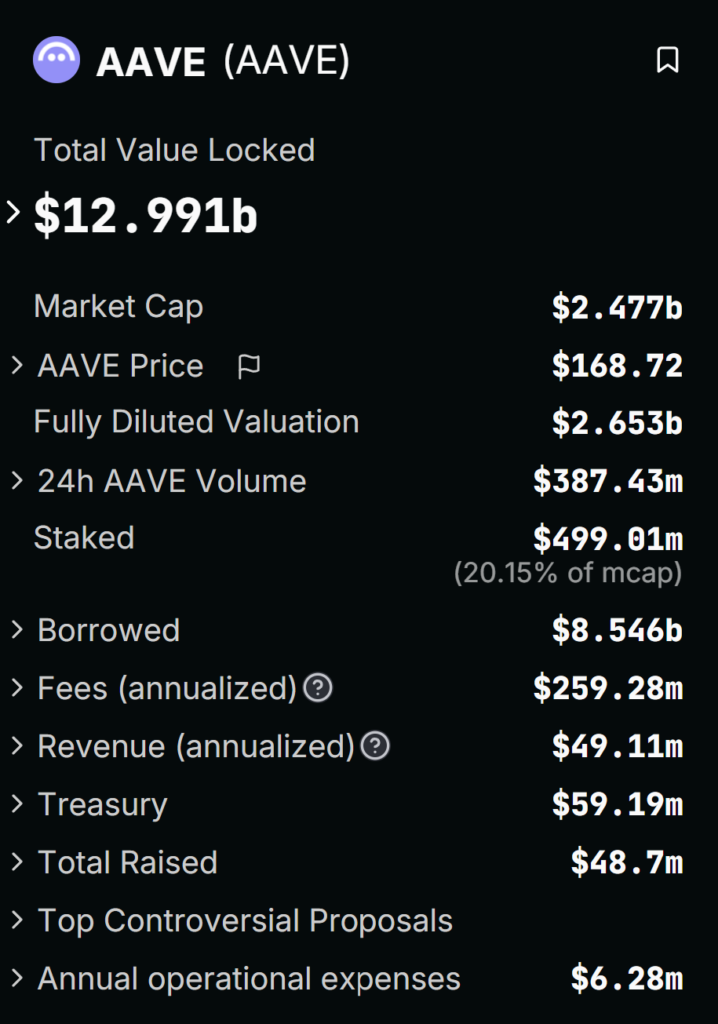

Revenue and Economic Sustainability

AAVE has the second-largest annual fee revenue of $259.28 million (after Uniswap) out of which it gets to keep $49.11 million after paying validators, stakers, and other stakeholders. The revenue is comparable to other major platforms like Uniswap ($368 million) Maker, Lido($80.78 million), Curve ($23.8 million), and Ethena ($82.44 million), and better than competitors like Pendle ($6.21 million), EtherFi ($3.15 million), and Just Lend ($3.61 million).

The treasury reserves are at $59 million and should be economically sustainable for the company in uncertain times. However, as per my belief, they should be around 2x the annual revenue, i.e., $100 million.

SWOT Analysis

Strengths

AAVE’s high liquidity and high TVL make it one of the top players in both DeFi as well as lending markets. Further, the introduction of its new stablecoin GHO gives it more room to maneuver in periods of less liquidity.

Weaknesses

AAVE is only available on Ethereum which limits its reach to other non-ETH networks like Solana, Bitcoin, TON coin, and Dogecoin. Though there is a WBTC version of Bitcoin available, yet there have been serious security risks with the usage of WBTC.

Opportunities

AAVE sees a strong growth in its DeFi business which is expected to have a growth rate of 45.6% for the next few years. Even if it manages to keep up with the market, which is easy for market leaders like AAVE, it can easily reach a revenue level of $2.3 billion by 2030.

Another opportunity lies in collaboration with cross-chain protocols like KASPA which will let AAVE expand its business to other chains as well. Kaspa helps token swaps of native tokens without the user losing their custody as opposed to centralized exchanges where you need to send your native tokens (say Bitcoin) to a CEX wallet and then swap to get another native token (say Dogecoin).

Threats

AAVE sees threats from the following blockchains and DeFi protocols, shown in decreasing order of priority.

- Eigenlayer: Despite a lower market presence, its TVL has reached almost equal to AAVE.

- Uniswap: This is the largest DeFi protocol and now has gone multi-chain as opposed to AAVE’s presence on only one chain, Ethereum.

Similar external threats also emerge from cross-chain DEX aggregators and multi-chain DeFi protocols.

Frequently Asked Questions

1. What are some of the risks associated with the AAVE protocol?

Risks associated with investing in AAVE protocol is that the project does not support multi-chain yield farming which is supported by its competitor Uniswap.

If you are worried about your funds getting stuck on that platform, don’t worry because AAVE currently enjoys around $20 billion in liquidity.

Further, AAVE does not have much risk, such as security because it operates on Ethereum.