With just a few days remaining for the Bitcoin Halving, crypto analyst Markus Thielen has expressed the possibility of a $5 billion Bitcoin selloff by crypto miners.

Lately, Bitcoin has witnessed an increase in miner activity as the halving event approaches which will reduce the rewards with each Bitcoin block from 6.25 BTC to 3.125 BTC.

Details of the Report

Veteran Crypto Analyst and former CEO of Matrixport, Markus Thielen has presented a report which warns the crypto community of an upcoming selloff in Bitcoin.

Apparently miners might sell as much as $5 billion worth of Bitcoins which they have been mining since the last Bitcoin ATH at $69k (November 10, 2021).

Bitcoin Could Remain Under Pressure for 6 Months

As per the report, Bitcoin might remain sideways for the next 6 months if all of these miner Bitcoins are sold in the market. Such a trend also did occur in previous Bitcoin Halvings claims the report.

The price of Bitcoin has already crashed about 8% last week due to several macroeconomic reasons , the most important of which is the low chances of a rate cut by the US Federal Reserve.

Further, the US government is about to sell $2 billion worth of Bitcoins in the open market which was seized from various illicit activities. As per Arkham Intelligence, the US government is estimated to hold $14.7 billion worth of Bitcoins.

Another $5 billion sale could potentially pressurize the price of Bitcoin to stay down This could continue till the time the market could absorb the selloff.

Miners Extracting Every Pre-Halving Bitcoin

After the Bitcoin Halving, crypto miners would only receive half the amount (3.125 BTC as compared to 6.25 BTC) of current Bitcoins for their mining activity.

As of now, 144 transaction blocks are mined everyday which yields roughly 900 Bitcoins. After the halving, the mining rate would drop to 450 Bitcoins per day, approximately, with the no of new blocks staying almost the same.

This has caused a race against time where miners are trying to extract as much Bitcoins as possible before the halving takes place.

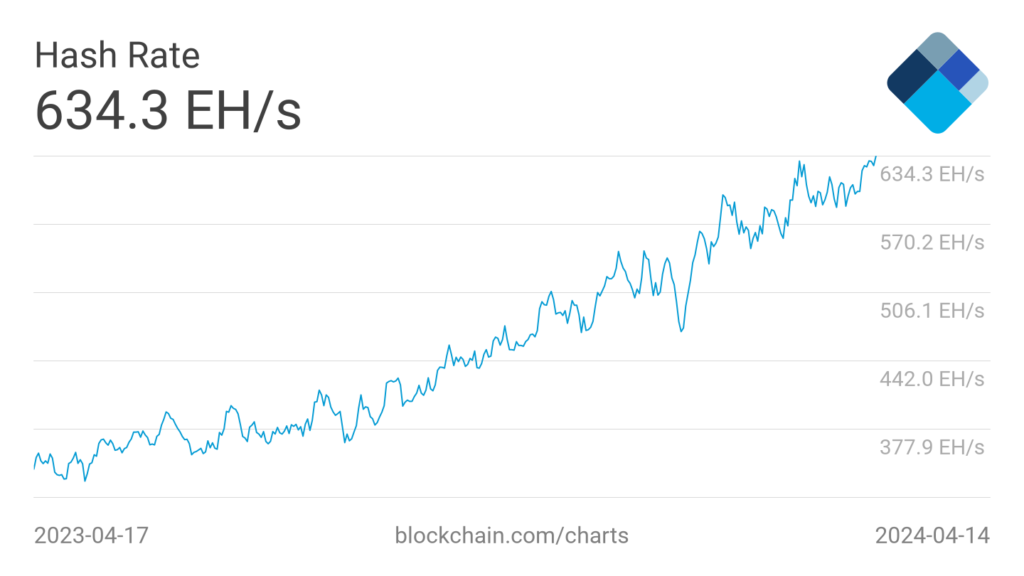

Data from Hash Rate Explorer of Blockchain.com shows that the Bitcoin hash rate is currently at its 52-week high. Hash Rate is a measure of the processing power which is available to validate Bitcoin transactions.

Disclaimer: The research/news presented by https://thelayer.cloud is presented for the purpose of education and knowledge and should not be considered otherwise. Please consult your financial advisor before trading or investing.